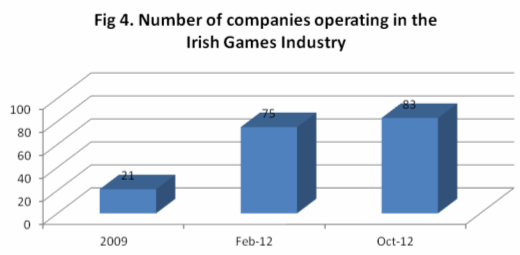

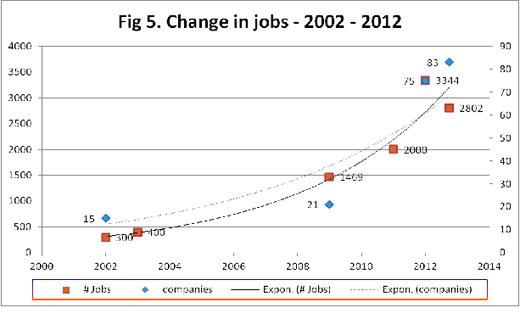

It is three years since Dr. Aphra Kerr’s and Dr. Anthony Cawley’s “The Games Industry in Ireland 2009”. Their survey estimated that there were 1,469 employed by 21 companies and noted that there had been a rapid growth in community support jobs in foreign owned companies. This new 2012 survey by Jamie McCormick identified 91% jobs growth since 2009 with over 2800 employed across 80 companies by October 2012. It also identified significant growth in the game development sector of activity in Ireland. A summary of the report is available below, but the full report is available from the author.

Methodology

The Irish Computer Games Survey 2012 was initiated in March 2012. A follow up survey to identify changes in the industry was conducted in October 2012. While not all the questions in the two surveys were identical, the same core questions were asked giving consistent results across the timeframe.

The survey was processed using Polldaddy and drew on direct responses, trusted industry sources, and bare-minimum estimates, (i.e. 1) for staff of identified companies who did not directly participate. It was promoted through the GameDevelopers.ie community, industry events, industry contacts, state agencies and internationally through GamesIndustry.biz.

The survey excludes several companies that work on games industry contracts, but who do not primarily derive their revenue from the games industry e.g those hosting customer contact centres for a games company. Gambling companies are also excluded. Recently acquired Irish companies are defined as ‘indigenous international’.

Findings of the March 2012 survey

The March 2012 survey estimated that there were at least 3,344 people working in the industry in Ireland in February 2012 in at least 75 companies. Of these indigenous companies (61) and indigenous international companies (3) employed 872. Foreign owned companies (14) employed almost 2472 staff.

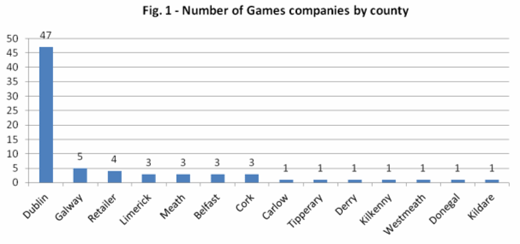

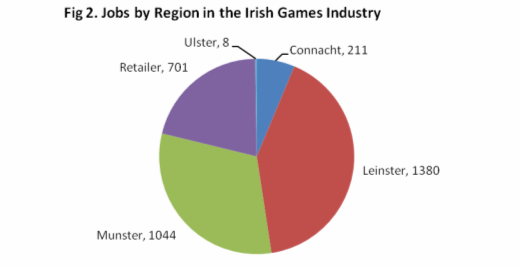

Figures 1 and 2 illustrate the location and distribution of the games industry around Ireland. While Dublin still dominates in terms of number of companies, Munster also has considerable numbers employed in the industry.

When companies were asked to indicate the type of company they worked for the following answers were given. These answers are further combined to evaluate the number of companies in each market sector.

Table 2 gives an overview of the types of positions advised by direct respondents of the survey.

Development Roles |

Publishing Roles |

Game Operation Roles |

Office Roles |

| Animator | Business Development | Community-Manager | Administration |

| Game-Designer | Distribution | Customer-Support | Finance |

| Graphic-Artist | Localisation | Games-Master | HR |

| Illustrator | Marketing | Producers | Management |

| Level-Designer | PR | ||

| Programmer | Product-Managers |

eLearning Roles |

Intern Roles |

| Project-Manager | QA | Education Liaison | Part-Time Interns |

| R&D | Sales | Full-Time Interns | |

| Software-Engineer | Testing | ||

| Sound-Designer | |||

| Sound-Engineer | Systems & Technology Roles | ||

| System-Architect | Cloud-Engineer | ||

| Tools | Network-Support | ||

| UI | Server-Operations | ||

| Web-Developer | System-Engineers | ||

| Web-Planner | |||

| Writer |

When we asked what platforms the companies were developing for almost 20 were working on IOS. The next most popular platforms were browser and PC with ten each. Significantly only two companies were working on games for the main consoles, Xbox and Playstation respectively.

Findings of the October 2012 Survey

A follow-up survey was completed in October 2012. During this survey, further information was attained from 27 companies.

It was found that one indigenous international company closed in the six month period between these reports. Two international companies removed their investment in the Irish market. A third international company announced redundancies which were completed during this timeframe. Between these, it is estimated that 590 jobs were lost.

Eleven companies responded to both surveys. Among these, four developers lost twenty-one staff, one had no perceptible change in staffing, and six of the developers employed ten additional staff between them. This produces a further net employment loss of 11 staff. It should be noted that most of these losses were in part-time, contractor or intern positions.

Nevertheless, a total of twelve new companies were identified in the October survey. Nine of which are comprised of one developer in Co. Down, seven additional developers in Dublin, and one more developer operating in both counties Dublin and Meath. An Industry Services team was the tenth with the remaining two operating as media outlets. Between these a total of 59 additional jobs were identified. The majority of these were formed in the last six months.

The figures from the October update show a net change reduction in employment of 542 job losses. This reduces the total estimated in the March figures to 2802 jobs. During the same period the number of companies increased from 75 to 83.

Just as we were completing the second survey a further 300 new jobs were announced by an international company, and 100 by an indigenous company. These are not included in these figures and hopefully will be capture in a future survey.

We also found in the follow up survey that five companies expanded the number of platforms they are releasing content on – four Android, two PC, one Xbox, one iOS, one Mac and one Linux games are being worked on in the six months between the two reports.

The following figures summaries the key findings over time.

Notes: It should be noted though that one international company and nine indigenous companies included in the 2012 report were also active in the Irish market at the time of the 2009 report. These include companies occupying the retail, sales, marketing, media and PR services sectors. The more macroscopic remit of this report allows them to be now included.

Conclusions

The survey highlights some important changes that are happening within the Irish Games Industry.

- The report shows a large increase in the number of developers within Ireland, most specifically in the Leinster region. Since 2009 there has been a 292% growth in the number of game developers.

- In terms of jobs growth, the industry has grown 91% in the three years since 2009 to an estimated total of 2802 workers.

- This survey indicates that iOS, mobile and web platforms are what indigenous developers are targetting. Few Irish companies develop for platforms like Facebook or consoles.

- There is a significant difference between employment numbers of companies who were pre-release on their first game, or only had one product currently published, against those developers who have progressed to having three or more games published on the market.

- There is a mismatch between the publishers and developers that operate in Ireland. The platforms that the international publishers located in Ireland work on versus those that are being developed on in Ireland are different. This means that local developers still need to make contact with international publishers located abroad.

- Few indigenous developers have got to the stage of internationalising their products through localisation into languages other than English. This may be an opportunity for export growth and sales, and leverage the skills currently available in Ireland among the publishers that exist in Ireland today.

- A critical mass of companies now exist in Dublin, but while the regional figures between Leinster and Munster may look similar on the surface, Munster and Connacht are heavily reliant on a small number of international companies for the majority of these jobs.

Recommendations

The international competitive landscape is going through a period of maturation as new business models shake out the games industry. The survivors of this should be well placed to deal with a future of reduced barriers to entry, reduced capital requirements and shorter development cycles enabling revenues to be generated sooner. Based on the figures from this survey we offer the following as recommendations for consideration by key stakeholders.

- Continue to make it easier for developers with viable products to get access to funding, mentoring and space to get their products made.

- Grow a number of developers, as a group, and aim that at least one will produce a hit game and cross-subsidise the rest – i.e. the hip hop business model.

- With the emergence of web, apps, and micro-transactions, there is an opportunity for Ireland to become an “IFSC for Virtual Currencies”, with a growing number of companies worldwide utilising micro-transactions or free-to-play business models. A micro-tax on the sale of virtual goods would give an incentive to the large number of Asian, American and European companies now utilising this business model for their games to establish in Ireland, channelling these revenues and jobs through Ireland.

- Aligning college courses with the current games industry, not only in development, but also in publishing and post-release services into the mid-term (5 years or so).

- Develop post-graduate or further education courses for incumbent senior management looking to formalise skills in areas such as Quality Assurance, Customer Services, Games Marketing and PR, Games Masters (inc Community Management) and other non-development skills that exist in Ireland today.

- Build on ten years of GameDevelopers.ie and Games Fleadh, both celebrating their tenth anniversary in 2013.

- Identify areas where skills gaps continue to exist, causing developers to leave Ireland, and focus on developing expertise in these areas.

- Attract back ex-pats with AAA credentials and get studios up and running with core “lead” talent, and then recruit in graduates to fill out other roles. A project to identify Irish people working in the international games industry is underway as a follow-on project to this report at http://tinyurl.com/irishexpatgamessurvey2012

- Continue to build a register of games companies operating in Ireland to track changes in the future. Companies that missed the October survey can still participate at http://tinyurl.com/irishgamessurveyoct12.

Published in Dublin, Ireland on Friday 16th November 2012 at Digital Skills Academy, The Digital Hub, Dublin 8, GAME: State of Play Exhibition at the Science Gallery, Dublin 2 and online at www.GameDevelopers.ie

Author Bio & Contact Details

Jamie McCormick is from Dublin, and has worked in the Irish Computer Games Industry since the late 90’s. A graduate of DIT, he has worked across retail, middleware, gaming centres, development and publishing companies in the Irish games industry, including with the Japanese-owned, Dublin based GALA Networks Europe, a publisher of free to play browser and client games across Europe through www.gPotato.eu. He now runs his own company Advanced Marcomm in Dublin. See http://advancedmarcomm.com/

The PDF of the full report is available at https://gamedevelopers.ie/features/TheGamesIndustryinIreland2012.pdf